Short Sale

The Complete Short Sale Process (from Listing to Bank Approval)

The short sale process is still a mystery to many people, even after all these years. Lots of buyer's agents are confused; puzzled buyers are looking for direction, and not every short sale listing agent knows how to do a short sale.

The Basics of a Short Sale

Banks grant short sales for 2 reasons: the seller has a hardship, and the seller owes more on the mortgage than the home is worth.

A few examples of a hardship are:

- Unemployment / reduced income

- Divorce

- Medical emergency

- Job transfer out of town

- Bankruptcy

- Death

The seller will need to prepare a financial package for submission to the short sale bank. Each bank has its own guidelines but the basic procedure is similar from bank to bank. The seller's short sale package will most likely consist of:

- Letter of authorization, which lets your agent speak to the bank.

- HUD-1 or preliminary net sheet

- Completed financial statement

- Seller's hardship letter

- 2 years of tax returns

- 2 years of W-2s

- Recent payroll stubs

- Last 2 months of bank statements

- Comparative market analysis or list of recent comparable sales

Writing the Short Sale Offer and Submitting to the Bank

Before a buyer writes a short sale offer, a buyer should ask his or her agent for a list of comparable sales. Banks are not in the business of giving away a home at rock-bottom pricing. The bank will want to receive somewhat close to market value. The short sale price may have little bearing on market value and may, in fact, be priced below the comparable sales to encourage multiple offers.

After the seller accepts the offer, the listing agent will send the following items to the bank:

- Listing agreement

- Executed purchase offer

- Buyer's preapproval letter and copy of earnest money check

- Seller's short sale package

If the package is incomplete, the short sale process will be delayed. In this event, the bank might even shred the package.

The Short Sale Process at the Bank

Buyers may wait a very long time to get a response from the bank. It is imperative for the listing agent to regularly call the bank and keep careful notes of the short sale process. Buyers may get so tired of waiting for short sale approval that they may feel the need to threaten to cancel if they don't get an answer within a specified time period.

That type of attitude is self-defeating and will not speed up the short sale process. If buyers are the type with little patience, perhaps a short sale is not for them.

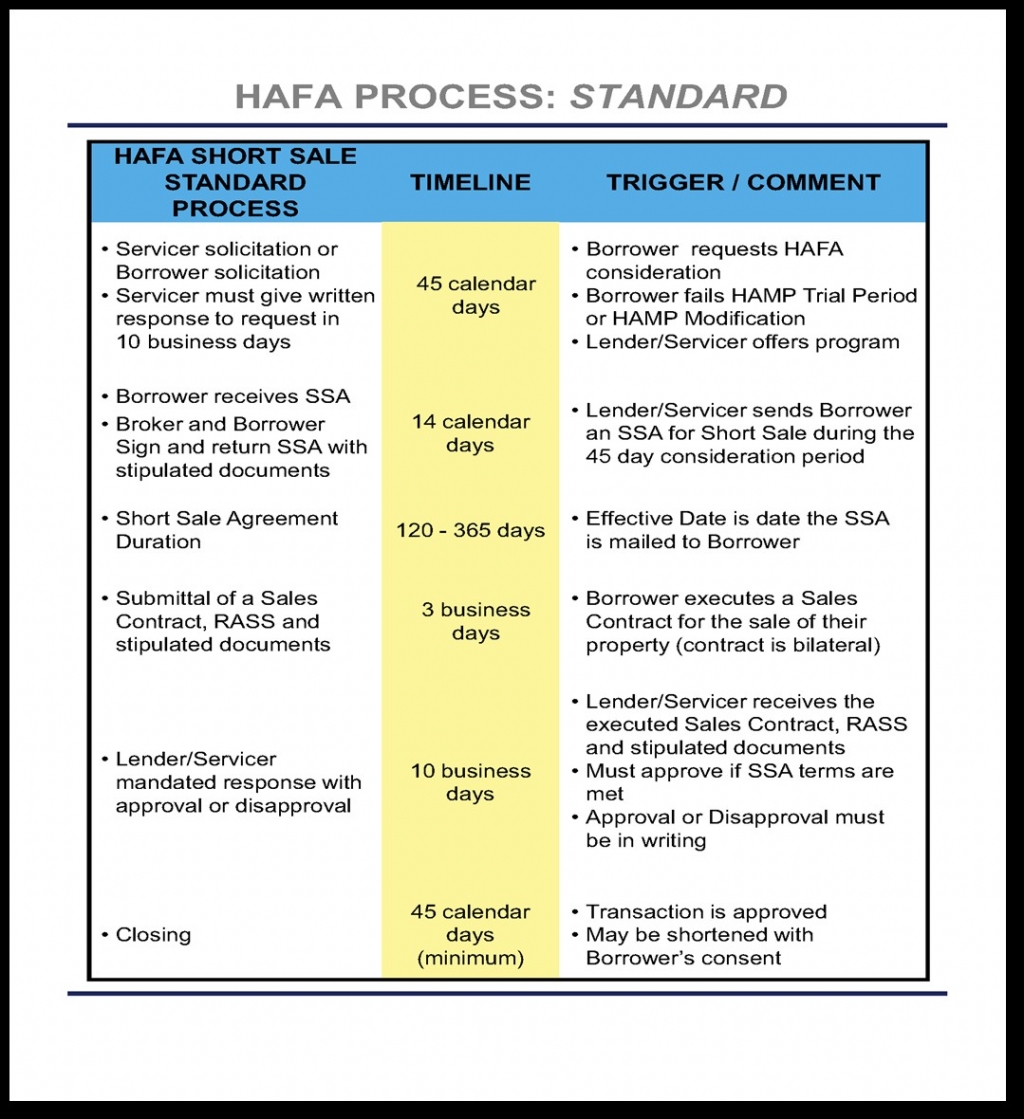

Following is a typical short sale process at the bank:

- Bank acknowledges receipt of the file. This can take 10 days to a month.

- A negotiator is assigned. This can take 30 to 60 days.

- A BPO is ordered. The bank probably will refuse to share the results of the BPO.

- A second negotiator may be assigned. This can take another 30 days.

- The file is sent for review or to the PSA. This can take 2 weeks to 30 days.

- The bank may then request that all parties sign an Arm's-Length Affidavit.

- The bank issues a short sale approval letter.

Some short sales get approval in 6 to 8 weeks. Others take 90 to 120 days, on average.

Tip: Generally the listing agent has some idea of when approval will come when the file is sent for final review. At that point, buyers may want to start the loan process so they've got a head start in case the bank gives 2 weeks to close.